Video podcast: HMS TechTalk where Magnus Jansson, Vice President Marketing at HMS Industrial Network Technology Division, elaborates on the trends and findings in the study.

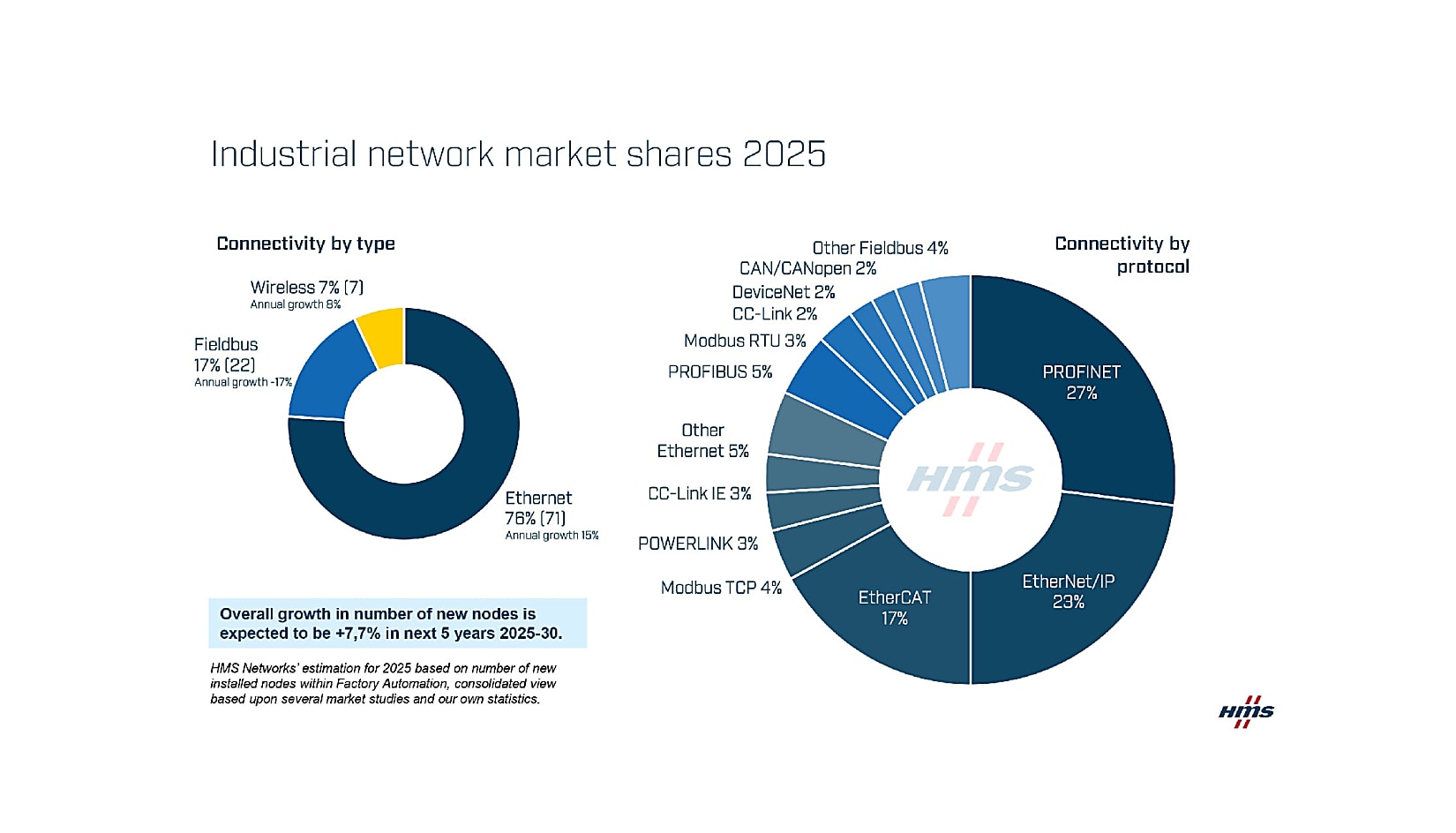

The 2025 analysis shows that Ethernet-based industrial networks now account for 76% of new nodes, up from 71% in 2024.

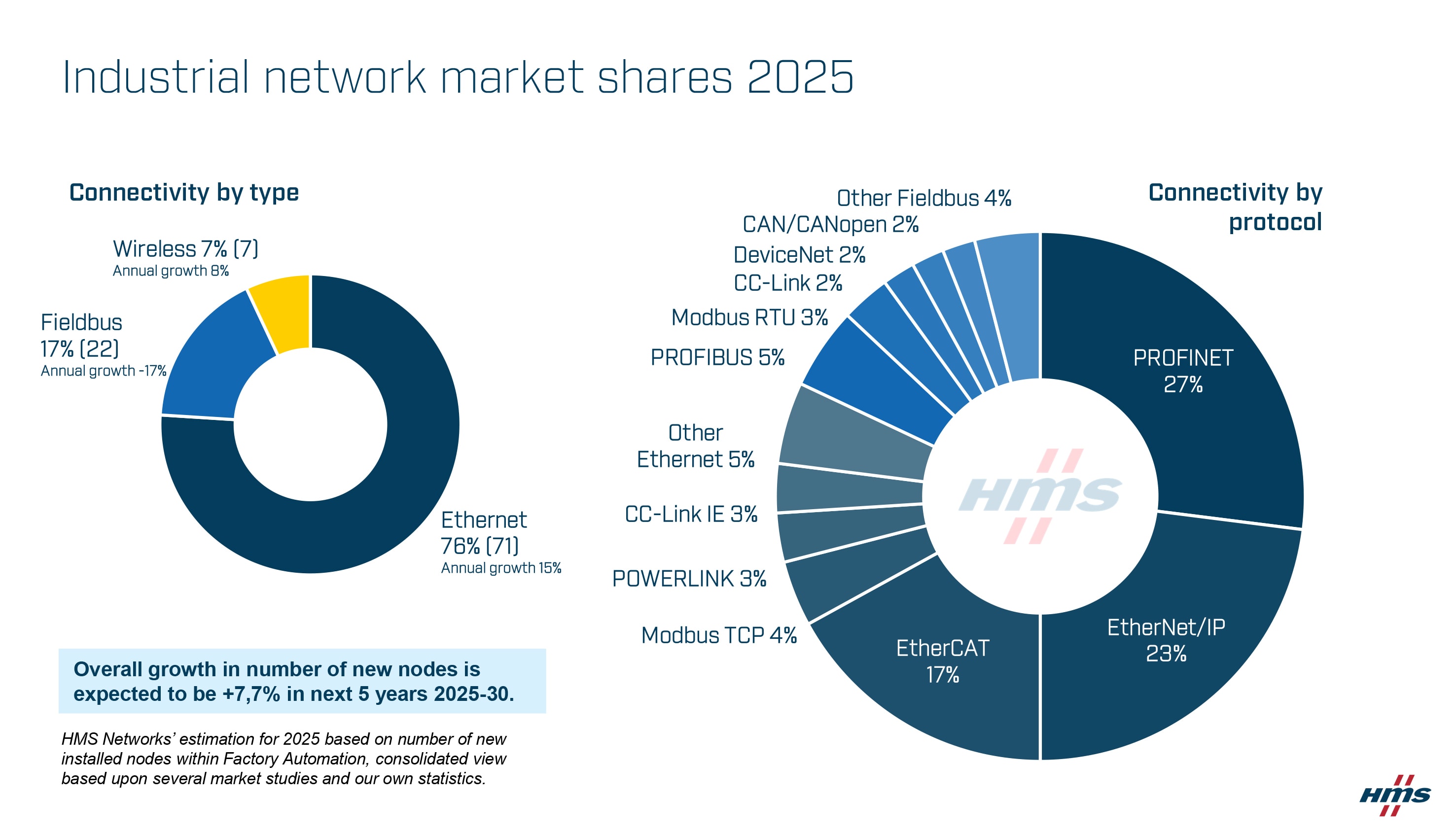

Leading the Ethernet pack:

Fieldbus technologies now represent just 17% of new nodes, down from 22% in 2024.

Within Fieldbus:

Wireless technologies interconnect 7% of new node installations, remaining stable compared to 2024. Wireless continues to be an important complement for non-real-time critical communications, mainly for use cases requiring mobility, flexible networking, or hard-to-reach areas such as in AGVs (automated guided vehicles), mobile industrial equipment, and retrofitting legacy systems.

5G wireless technology, currently implemented for mobile telecom usage, is still experiencing slow adoption in industrial automation. This is due to the complexity of infrastructure management, high implementation costs, and challenges in achieving affordable real-time performance in cellular chips. However, despite these barriers, early industrial deployments, particularly in Asia, are already underway, and the technology holds exciting potential for the future of industrial communication.

Europe: Strong adoption of PROFINET and EtherCAT, with increasing interest in new infrastructure technologies like APL (Advanced Physical Layer) to enable Ethernet communication for process automation applications, and SPE (Single Pair Ethernet) for Ethernet communication up to sensors.

North America: EtherNet/IP remains the leading protocol in North America, but adoption of smart device-friendly technologies like IO-Link, APL, and SPE is clearly growing, with strong market momentum expected in the coming years.

Asia: PROFINET and EtherCAT are both growing in the Chinese market, while CC-Link IE, the first industrial protocol with TSN mechanism, maintains a strong regional foothold.

“This year’s data clearly confirms the ongoing shift from traditional fieldbuses to Industrial Ethernet. It’s a transition driven by the need for more modern network capabilities in today’s automation systems,” says Magnus Jansson, VP Marketing at HMS Networks. “While Industrial Ethernet is now well-established, we still see strong growth due to an appetite for more information and the digitalization of the industry. The Ethernet infrastructure also paves the way for further innovation toward gigabit Ethernet, TSN, Single Pair Ethernet, and OT/IT convergence.”

Magnus Jansson, VP Marketing at HMS Networks.

The average annual growth expectation over the coming 5 years is estimated at 7.7%, despite the short-term political and economic uncertainties and upcoming cybersecurity regulations that will force automation companies to rethink the way they connect automation systems.

Shape the future of Industrial Networking

Your voice matters! Take our short survey to share your insights and help guide next year’s market report. As a thank-you, you’ll get early access to the full results.

About the study

The HMS Networks analysis is based on a combination of market insights, internal data, and input from key stakeholders in the industrial automation industry. The study focuses on newly installed nodes in factory automation worldwide, each node being a device or machine connected to an industrial control network.